U2Me Skill Development & Research Private Limited

About Us

Vision:

Vision:

Youth Inclusiveness/Employment in Micro Finance Industry (MFI) with the scope of long term career path for 2 lakh candidates by 2025.

Mission:

Mission:

- To launch a practical based training program to operate and manage Micro Finance

- To work as a human capital solution

- To develop a network in terms of scoping employment

- To built a partnership the resource person for training facilitation and sharing knowledge & information

- To build a global standard and leading learning institution to meet up the future need of MFI

Dear Reader,

The microfinance industry in itself has the potential to generate thousands of job opportunities and with the increase in scale of operation in the industry the job opportunities are also bound to increase. As the sector is growing fast, there will be a huge scope for thousand of job creations by 2020. As per the records of Reserve Bank of India’s Self Regulatory Organization (MFIN) there has been a growth of 25% of active employees in MFI Industry. What lack behind is the quality and trained employees. Therefore U2Me Skill Development core curriculum is here as a survival strategy for the deserving candidates. The sector provides interesting and challenging opportunities leading to a sense of fulfillment and job satisfaction.

To achieve scale and spreading of operations, Microfinance Institutions (MFIs) require skilled human resources to fuel such growth. The outreach of the Microfinance Industry in India is high and the industry is among the most efficient in the world. In India micro finance is mainly based on rural and semi-urban area. There is a good scope and opportunity in micro finance sector however one needs to groom properly before choosing this industry for their future career path. U2Me Skill Development courses are a platform for survival of fittest or introductory level training program on microfinance.

Background

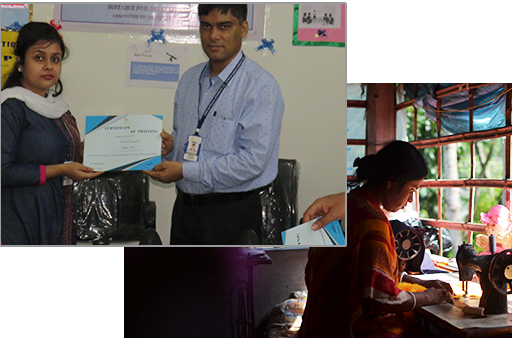

U2me Skill Development Pvt. Ltd, a group company of Uttrayan Financial Services, is pleased to introduce a comprehensive and immersive training program on Microfinance. The training provides a route for students to gain a deep understanding of microfinance. The program has been developed by a group of practitioners with over seventeen years of experience in the microfinance sector.

Uttrayan Financial Services Private Limited, a Non Banking Financial Company (NBFC-MFI) registered under Reserve Bank of India (RBI) started its microfinance on-lending operation way back in the year 2001 with its head office at Kolkata (West Bengal), by providing small ticket size loan to the poor woman in rural and semi-urban area through group based system. The Company provides livelihood promotion services comprising of livelihood and other Micro financial services to those population segments which are mostly un-reached by the formal banking systems with the principal purpose of promoting sustainable livelihoods. It is one of the few MFIs in West Bengal who have been managing portfolio as Business Correspondent of both public sector and private sector Banks. This speaks about the confidence reposed on the company for effective control and management of micro finance business of Banks. The Board of Directors of the company consists of a combination of the Executive Directors with vast experience in the Microfinance sector and the Non Executive Directors drawn from the retired executives of Banks and Financial Institutions.

WHY CHOOSE US?

We as an institution are always pioneer to execute new ideas addressing the needs of the MF sector. Besides, the followings are the strength of our initiative which makes us more exceptional:

- Our leadership by MF practitioners those who have long experience in national and international level

- We are using modern technology in training facilitation

- We have high qualified and experienced resource persons

- We are going through a practical based learning process